The Essential Talent Acquisition KPIs for Driving Business Success in the UAE

The Essential Talent Acquisition KPIs for Driving Business Success in the UAE

For forward-thinking HR and Talent Acquisition Leaders in the UAE’s competitive market, the question is no longer if you should measure your recruitment efforts, but what you should measure. True influence comes from moving beyond simply filling vacancies to connecting your people strategy directly to tangible business results.

It’s not just about speed; it’s about using data to build a resilient, high-performing organization that can thrive in a dynamic economic landscape. At Green Line Pioneers, we partner with UAE businesses to transform their talent acquisition function from a cost center into a strategic powerhouse.

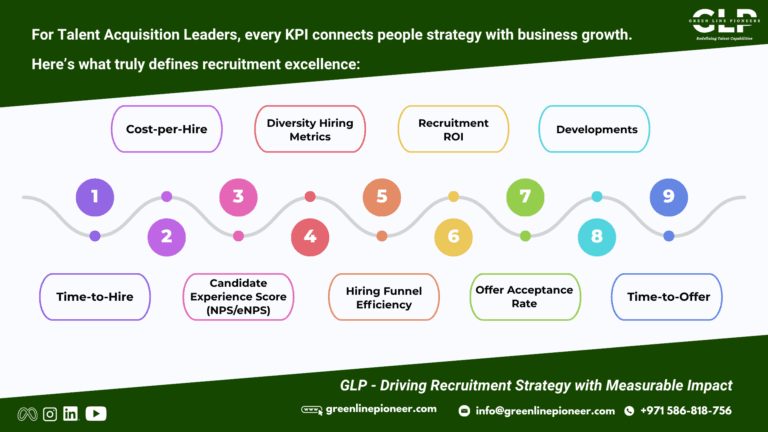

So, which metrics truly matter? The most effective TA leaders focus on a balanced scorecard of KPIs that cover four critical areas.

The 4 Pillars of High-Impact Talent Acquisition Metrics

To build a holistic picture of your recruitment function’s health, you need to look at a combination of operational, financial, qualitative, and strategic data.

- Operational Efficiency: The Speed and Smoothness of Your Engine

These metrics tell you how quickly and smoothly your recruitment machine is running. In a fast-paced job market like the UAE, efficiency is key to securing top talent before your competitors do.

- Time-to-Hire: The golden standard. This measures the number of days from when a candidate enters your pipeline to when they accept your offer. A prolonged time can mean losing great candidates.

- Time-to-Offer: A more specific subset of time-to-hire, this focuses on the efficiency of your internal decision-making process from final interview to offer extension.

- Hiring Funnel Efficiency: How many candidates move from one stage to the next? Analyzing drop-off rates at each stage (application, screening, interview) helps you identify and fix bottlenecks.

- Recruiter Productivity: Measures the output of your recruitment team, often through roles filled per recruiter per quarter. This helps in resource allocation and workload management.

- Financial and Resource Stewardship: Maximizing Your Investment

Every dirham spent on recruitment must be justified. These metrics ensure you are getting a strong return on your investment and using your resources wisely.

- Cost-per-Hire: A classic KPI that calculates the total cost of bringing a new employee on board. This includes advertising, recruiter salaries, agency fees, and onboarding costs.

- Recruitment ROI: This goes beyond cost-per-hire by measuring the value a new hire brings against the cost of acquiring them. Are your top performers justifying the investment it took to recruit them?

- Source Channel Effectiveness: Which channels (LinkedIn, job boards, employee referrals, agencies) are delivering your highest-quality candidates at the lowest cost? This allows you to double down on what works and cut what doesn’t.

- Quality and Long-Term Value: Looking Beyond the Start Date

Filling a role quickly is meaningless if the hire doesn’t work out. These metrics focus on the long-term success and retention of your new employees, which is crucial for stability in the UAE’s mobile workforce.

- Quality of Hire: The ultimate measure of recruitment success. This can be a composite score based on performance reviews, manager satisfaction, and cultural fit.

- First-Year Attrition Rate: What percentage of new hires leave within their first 12 months? A high rate indicates potential flaws in your selection process, job preview, or onboarding.

- Offer Acceptance Rate: How many of your offers are accepted? A low rate could signal uncompetitive compensation, a poor candidate experience, or a weak employer brand.

- Internal Mobility Rate: Are you effectively filling roles from within? A strong internal mobility program boosts retention and reduces reliance on external hiring.

- Candidate and Strategic Impact: Building for the Future

These forward-looking metrics assess your employer brand and your readiness to meet future business challenges.

- Candidate Experience Score (NPS/eNPS): Measures a candidate’s satisfaction with your hiring process. A positive experience strengthens your employer brand, while a negative one can damage it.

- Diversity Hiring Metrics: Tracking the diversity of your hires and pipeline is not just a compliance issue; it’s a business imperative for fostering innovation and representing your customer base.

- Critical Roles Coverage: Do you have a ready pipeline for the roles that are most critical to your business strategy? This is essential for risk management and succession planning.

- Candidate Pipeline Health: A measure of the quantity and quality of candidates in your talent pool for key roles, ensuring you are never starting from zero.

The Green Line Pioneers Advantage: Data-Driven Recruitment for the UAE

When these metrics work together, they paint a clear, actionable picture of your recruitment function’s health and its direct contribution to the business. The goal is not to track every number, but to track the right numbers that align with your strategic objectives.

At Green Line Pioneers, we work with HR leaders across the UAE to build recruitment systems grounded in data, designed for clarity, and built to make a difference. We help you move from reactive hiring to a proactive talent strategy that drives growth.

Ready to transform your approach to talent? Contact Green Line Pioneers today for a free consultation on your recruitment metrics and strategy.

Contact Us Today to Strengthen Your Talent Acquisition Capabilities!

Green Line Pioneers

Website: www.greenlinepioneer.com

Email: info@greenlinepioneer.com

Phone: +971 586-818-756

Frequently Asked Questions (FAQs) About Talent Acquisition KPIs in the UAE

There is no single “most important” KPI. However, a combination of Time-to-Hire and Quality of Hire provides a powerful snapshot. Speed is critical in the UAE job market, but it cannot come at the expense of hiring the right person for the long term.

The UAE has a highly mobile and competitive job market. A high first-year attrition rate is incredibly costly and indicates a potential mismatch in expectations during the hiring process, poor onboarding, or uncompetitive packages. It directly impacts team stability and business continuity.

Focus on communication, transparency, and respect. Provide timely updates, offer constructive feedback, and ensure the interview process is streamlined. A positive candidate experience, even for rejected applicants, turns candidates into brand advocates.

While this varies by industry and role, LinkedIn, specialized job portals like Bayt and GulfTalent, and employee referral programs are consistently highly effective. The key is to track your Source Channel Effectiveness to see which ones deliver the best candidates for your company.

It can be a composite index that includes:

- Performance review scores after 6-12 months.

- Retention rates after the first year.

- Manager satisfaction surveys.

- Achievement of key milestones in the probation period.

Green Line Pioneers

Redefining Talent Capabilities

Explore us on Social Media