Navigating the New Era of End-of-Service Benefits in the UAE and GCC

For HR leaders and business owners in the UAE, managing end-of-service benefits (ESB) is evolving from a routine administrative task into a critical strategic challenge. Recent regional reforms and growing financial liabilities are transforming the landscape, making it essential for companies to move beyond basic compliance. This guide examines the key shifts, the risks of inaction, and the practical steps your organization can take to secure its future and support its workforce.

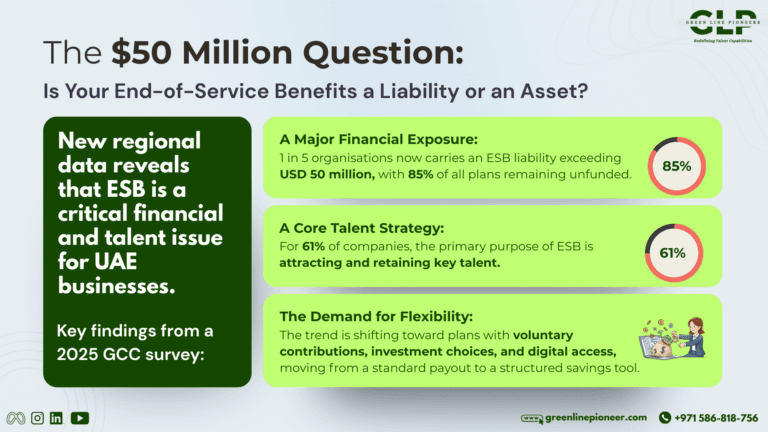

The Growing Weight of ESB Liabilities

End-of-service benefits are a fundamental part of the employment contract in the GCC, mandated for expatriate employees. However, the traditional “pay-as-you-go” model, where liabilities are simply recorded on the balance sheet until an employee leaves, is becoming increasingly unsustainable for many organizations.

Data from a 2025 GCC-wide survey reveals a sharp rise in ESB obligations, driven by three primary factors:

- Increased Headcount (56%): Business growth naturally expands the employee base and corresponding future liabilities.

- Longer Employee Tenure (39%): As workforce stability increases, so does the accumulated benefit for each employee.

- Rising Reference Wages (34%): Benefits are calculated on final salary, meaning wage inflation directly increases the payout amount.

The consequence is that one in five organizations now reports an ESB liability exceeding USD 50 million—a significant increase from just 6% a decade ago. For many businesses, this represents a substantial, off-balance-sheet financial risk.

The Critical Risk of Unfunded Benefits

Perhaps the most pressing finding is that 85% of organizations in the GCC continue to operate with unfunded ESB arrangements. This “unfunded” status poses a dual threat:

- Employee Risk: Employees are exposed to potential financial loss if the company faces insolvency or severe cash flow issues during an economic downturn, jeopardizing their earned entitlements.

- Employer Risk: A large, unforeseen exodus of employees can create sudden and severe pressure on corporate cash flows, as significant lump-sum payments come due simultaneously.

This underscores that robust HR compliance and legal guidance is no longer just about calculating gratuity correctly; it’s about implementing sound financial risk management to protect both the company and its people.

The Shift Towards Funded and Future-Proof Solutions

Recognizing these risks, GCC governments are actively encouraging a transition to funded models—where money is set aside in a secure vehicle during an employee’s tenure. While adoption has been slow, several funded solutions are available in the region:

- Government-Managed Schemes: Such as Bahrain’s Social Insurance Organisation.

- Employer-Sponsored International Plans: Including International Pension Plans (IPPs) or International Savings Plans (ISPs).

- Local Approved Plans: Like the DIFC Employees’ Workplace Savings (DEWS) plan.

These models transform ESB from a looming liability into a managed, segregated asset, enhancing security and financial planning for all parties.

The Future: From Mandated Compliance to Valued Employee Choice

The next evolution of ESB is already taking shape, moving from a passive obligation to an active component of talent strategy. Forward-thinking employers are exploring designs that add flexibility and value, such as:

- Allowing voluntary employee contributions with matching employer contributions.

- Offering Shariah-compliant and diversified investment options.

- Providing digital access and financial planning support to help employees visualize their savings.

These enhancements aim to deliver greater transparency, portability, and long-term value, positioning ESB as a key tool for attracting and retaining top talent in a competitive market.

Strategic Actions for UAE Employers

To navigate this changing landscape effectively, companies should consider a structured approach:

- Conduct a Liability Assessment: Quantify your total ESB obligation and model its projected growth under different scenarios.

- Evaluate Funding Options: Research the various funded solutions available in your jurisdiction, comparing costs, governance, and employee benefits.

- Develop a Phased Implementation Plan: For many, a full immediate switch may not be feasible. A plan might start with funding for new hires or certain employee groups.

- Communicate Transparently: When changes are made, clear communication is vital to ensure employee understanding and trust.

Seek Expert Guidance: Engage with HR compliance and legal guidance specialists who understand both the regional regulations and the financial instruments involved.

Ready to move from skill-based hiring to capability-led growth?

Contact Green Line Pioneers today. Let us help you build a team that is truly ready for the future.

Green Line Pioneers – Your Partner in Strategic HR Consultancy in the UAE

Phone: +971 586-818-756

Email: info@greenlinepioneer.com

Website: www.greenlinepioneer.com

Frequently Asked Questions (FAQs): Team Management in the UAE

ESB, often called gratuity, is a lump-sum payment mandated by UAE law for expatriate employees upon the termination of their contract, calculated based on their length of service and final wage.

GCC governments are reforming frameworks to promote funded, secure savings arrangements that protect employees’ rights and improve long-term financial resilience for both individuals and businesses.

Unfunded means the company has recorded the liability on its accounts but has not set aside the cash or assets to cover it. It poses a risk to employees if the company cannot pay and a risk to the company’s cash flow if many employees leave at once.

Options include international pension/savings plans, local approved plans like DEWS in the DIFC, and, where available, government-managed schemes. The choice depends on your company’s location, size, and specific needs.

By allowing voluntary contributions, offering investment choices, and providing digital tools, you transform a standard entitlement into a personalized savings benefit. This demonstrates a commitment to employees’ long-term financial well-being, enhancing your value proposition.

It is crucial to consult with experienced HR compliance and legal guidance providers, like Green Line Pioneers, who specialize in UAE labor law and can help you develop a strategy that balances compliance, risk management, and talent objectives.

Green Line Pioneers

Redefining Talent Capabilities

Explore us on Social Media